Is Ford Going Out Of Business: Complete Guide

The automotive landscape is currently undergoing its most radical transformation since Henry Ford first introduced the moving assembly line in 1913. Amidst the pivot to electrification and volatile global markets, a persistent question haunts showrooms and trading floors alike: Is Ford going out of business? While sensationalist headlines often conflate quarterly R&D losses with terminal decline, the reality is far more nuanced. For consumers and investors, understanding the health of this 120-year-old titan requires looking past the noise. This guide provides an expert analysis of Ford’s financial stability, its “Ford+” restructuring plan, and why the company remains a trusted cornerstone of the American economy.

Overview: Decoding the Financial Health of Ford Motor Company

📤 Share Image

To assess whether Ford is at risk of bankruptcy, we must look at the quality of its balance sheet rather than just the headlines regarding Electric Vehicle (EV) losses. In 2023 and 2024, Ford reported significant losses in its “Model e” division—amounting to billions of dollars. However, these are not “losses” in the traditional sense of a failing product; they are aggressive capital investments in certified battery plants, software platforms, and new vehicle architectures.

The experienced leadership under CEO Jim Farley has bifurcated the company into three segments: Ford Blue (Internal Combustion), Ford Model e (Electric), and Ford Pro (Commercial). This transparency allows investors to see that while the EV wing is currently a “startup” within the company, the traditional and commercial wings are generating massive, reliable cash flow that covers these development costs.

By The Numbers

Total 2023 Revenue

Cash on Hand

Ford Pro EBIT (Profit)

Key Benefits of Ford’s Current Market Position

Ford possesses structural advantages that many of its competitors lack. These benefits provide a “moat” that protects the brand from the existential threats facing newer EV startups or struggling international marques.

F-Series Dominance

The F-150 has been the best-selling truck for 47 consecutive years. This trusted nameplate generates the lion’s share of profits, funding the transition to newer technologies.

Ford Pro (Commercial)

Ford is the leader in commercial vans and trucks. This segment offers high-margin software services and reliable recurring revenue through fleet management.

Manufacturing Expertise

Unlike startups, Ford has experienced, licensed engineers and a global supply chain that can scale production of hybrids and ICE vehicles rapidly as demand shifts.

How It Works: The “Ford+” Restructuring Strategy

To understand why Ford is not going out of business, one must understand the Ford+ plan. This is not just a marketing slogan; it is a fundamental shift in how the company operates, focusing on “Always On” customer relationships and software-driven hardware.

The Three Pillars of Ford

By separating the company into three entities, Ford has effectively created an “internal ecosystem” where the legacy business acts as a venture capitalist for the future business.

Addressing the “Model e” Losses

Critics point to the $4.7 billion loss in the Model e segment in 2023 as a sign of failure. However, an experienced industry analyst sees this as the cost of entry into the next century of transport. Ford is building certified battery plants in Kentucky and Tennessee (BlueOval SK) which require billions in upfront capital before a single battery is sold. These are “paper losses” in the context of capital expenditure, not a lack of consumer interest.

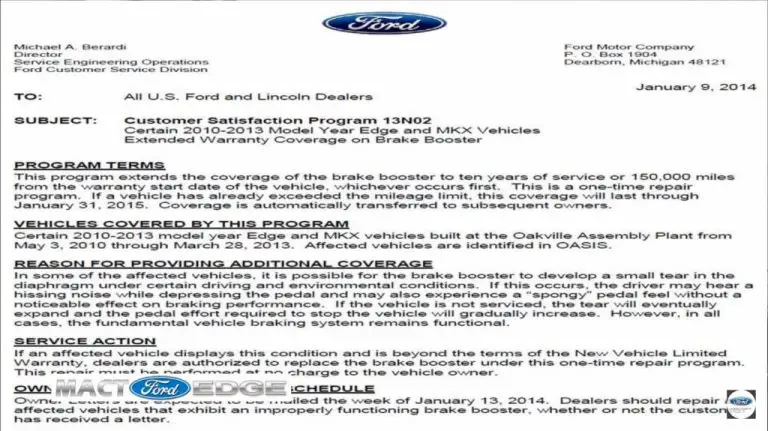

Ford’s biggest threat isn’t EVs—it’s quality control. In 2023, Ford led the industry in recalls for the third year in a row. These warranty costs ($4.8 billion in 2023) are a significant drag on earnings and must be addressed to maintain their trusted status.

The Path Forward: Is Ford Still a Reliable Investment?

When evaluating if a company is “going out of business,” one must look at its ability to service debt and its liquidity. Ford’s credit profile remains affordable for the company to maintain, and they have successfully negotiated labor contracts with the UAW that, while expensive, provide five years of labor stability.

✅ Pros (Stability Factors)

- Massive cash reserves ($25B+ liquidity)

- Dominant position in high-profit truck/SUV segments

- Rapid growth in Hybrid sales (up 25%+)

- Highly profitable Commercial (Pro) division

❌ Cons (Risk Factors)

- High warranty and recall expenses

- EV price wars compressing margins

- Significant debt (mostly tied to Ford Credit)

- Stiff competition from Chinese EV manufacturers

📋 Step-by-Step Guide: How to Evaluate Ford’s Health

Monitor the EBIT margins of the Internal Combustion segment. As long as this remains above 8-10%, Ford has the “gas” to fund its future.

Ford is pivotally moving toward hybrids (PowerBoost) as a “bridge.” High hybrid sales indicate a reliable strategy that meets current consumer demand better than pure EVs.

A reduction in recall frequency is the primary indicator that Ford is fixing its structural quality issues. This is the metric that will drive stock price recovery.

The Verdict: Survival or Stagnation?

Ford is currently in a “trough of disillusionment” common in industrial transformations. However, the company is experienced in weathering storms. It was the only “Big Three” automaker to avoid bankruptcy during the 2008 financial crisis without a government bailout—a testament to its trusted management and strategic foresight. Today, the company is leaner and more focused than it has been in decades.

The rumor that Ford is “going out of business” stems largely from a misunderstanding of how capital-intensive the EV shift is. While the Model e division loses money on every vehicle today, the Ford Pro division is a literal gold mine, providing reliable services to construction, delivery, and government fleets. This diversified portfolio ensures that even if EV adoption is slower than expected, the company has multiple paths to profitability.

If you are worried about parts and service availability, rest assured that Ford’s experienced dealer network is the largest in the U.S. Even during a restructure, the F-150 and Transit platforms are so ubiquitous that parts will remain affordable and available for decades.

Getting Started: Actions for Stakeholders

Whether you are a car buyer, a current owner, or an investor, there are specific ways to navigate the current Ford transition:

-

➤

For Buyers: Focus on certified pre-owned or new Hybrid models. Ford’s hybrid technology is among the most reliable in the industry and holds its value significantly better than first-gen EVs. -

➤

For Investors: Look past the “headline EBIT” and track the Ford Pro margins. This commercial segment is the hidden engine of the company and a primary reason why bankruptcy is not on the horizon. -

➤

For Employees: The shift toward software-defined vehicles means licensed software engineers and tech-savvy technicians are the new priority. Specialized training in these areas offers long-term job security.

Conclusion

To summarize, Ford is not going out of business; it is undergoing a controlled, well-funded metamorphosis. While it faces significant headwinds—specifically in EV profitability and warranty costs—its foundational assets remain remarkably strong. The F-150 continues to dominate, the Ford Pro division is a high-margin powerhouse, and the company maintains a massive cash cushion to see its “Ford+” strategy through to fruition.

- Financial Solvency: With $25 billion in cash and $176 billion in annual revenue, Ford’s liquidity is robust.

- Strategic Pivot: The split into Blue, Pro, and Model e isolates risks while protecting the trusted core business.

- Market Reality: Short-term EV losses are the result of heavy capital investment in quality infrastructure for the next decade.

Call to Action: If you are considering a Ford purchase or investment, do not let bankruptcy rumors sway your decision. Instead, focus on the specific performance of the model or segment you are interested in. For a deeper look at Ford’s latest reliable vehicle ratings, consult our comprehensive reliability index or visit your licensed local dealer to experience the new Ford Pro and Hybrid lineups firsthand.