The Definitive Report on Ford Protect Contract Termination: Financial Logistics, Regulatory Compliance, and Asset Recovery

The automotive ownership lifecycle is increasingly defined not just by the mechanical operation of the vehicle, but by the financial instruments attached to the chassis. Among these, the Extended Service Plan (ESP)—marketed by Ford Motor Company as “Ford Protect”—represents a significant capital commitment, often exceeding $2,000 to $4,000 at the point of sale.

While these contracts are positioned as risk mitigation strategies against mechanical failure, they are fundamentally financial assets with specific liquidity terms. The ability to divest from this asset—to cancel the contract and recover unearned premiums—is a critical consumer right, yet it is often obscured by procedural opacity, dealership conflict of interest, and complex regulatory variation.

This report serves as an exhaustive analysis of the Ford Protect cancellation ecosystem. It is designed to function as the authoritative reference for vehicle owners, financial professionals, and automotive researchers. By synthesizing data from official Ford directives, dealership operational protocols 4, and state-level insurance statutes 6, this document deconstructs the mechanisms of cancellation.

It addresses the financial calculus of prorated refunds, the legal distinctions between “service contracts” and “insurance” in jurisdictions like Florida and California, and the strategic arbitrage available to consumers who leverage the competitive online warranty market.

The narrative that follows moves beyond basic instructional advice. It analyzes the “Finance and Insurance” (F&I) business model that creates resistance to cancellation, the actuarial mathematics that determine refund values, and the specific documentation requirements necessary to navigate the bureaucracy of Ford Protect Administration.

Whether due to the sale of the vehicle, a total loss event, or simple buyer’s remorse, the termination of a Ford extended warranty is a precise contractual procedure. This report provides the granular detail required to execute that procedure with optimal financial recovery.

How to Cancel Your Ford Extended Warranty

Stop paying for coverage you don’t need. A complete data-driven guide to the Ford Protect cancellation process, refunds, and timelines.

Yes, It Is Cancellable.

Ford Protect contracts (often called ESPs) are voluntary service contracts. You have the legal right to cancel them at any time for a refund. The amount you get back depends strictly on when you cancel relative to the purchase date.

Refund Potential

Full refund if cancelled within

30 days

(and no claims made).

The “Pro-Rated” Refund Curve

After 30 days, your refund is pro-rated based on time or mileage (whichever is greater), minus a standard processing fee (usually $75). This chart simulates the refund value of a $2,500 warranty over 5 years.

Note: The refund is calculated based on the lesser remaining value. If you drive 20,000 miles in Year 1, your refund drops faster than time alone would dictate.

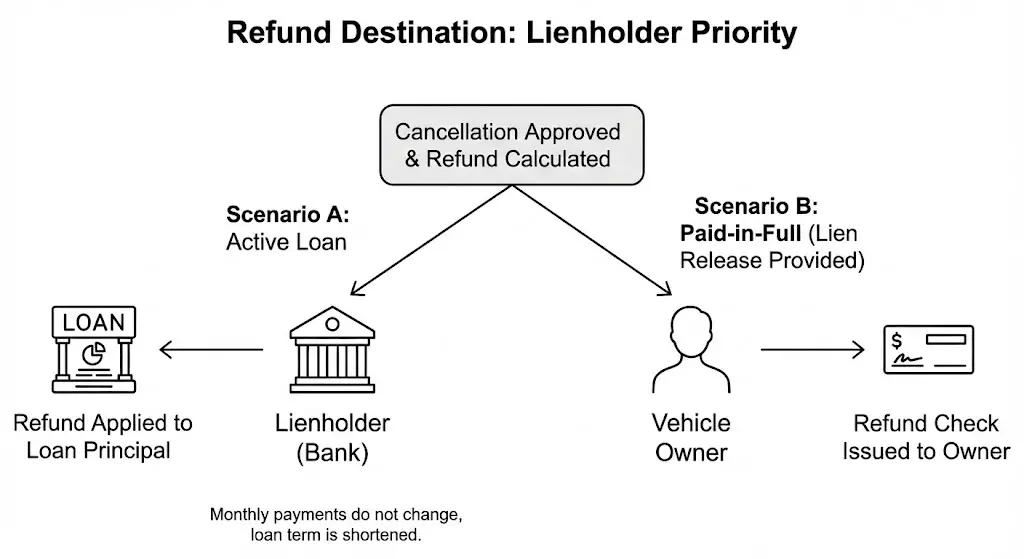

Who Gets the Check?

A common misconception: “I’ll get cash back.” If you financed the car, the refund usually goes to your lienholder (bank) to reduce your principal balance, not your pocket.

- ● Lienholder: If the loan is active, the money reduces your debt (lowering payoff date, not monthly payment).

- ● You (Check): Only if the car is paid off OR you provide proof of payoff with the cancellation.

The Cancellation Workflow

You generally cannot cancel online. You must go through the dealer or Ford corporate. Here is the most effective path.

Gather Docs

Get your contract number and a notarized odometer statement (critical).

Contact Dealer

Visit the Finance Manager at the selling dealer. Request the “Cancellation Form.”

Dealer Refusal?

If the dealer stalls, send a registered letter directly to Ford Protect HQ.

Wait 4-6 Weeks

Check your loan balance. The refund usually appears as a principal reduction.

Paperwork Checklist

Missing one of these documents is the #1 reason cancellations are rejected or delayed.

-

✓Ford Protect Contract Number

-

✓VIN (Vehicle Identification Number)

-

✓Notarized Odometer Statement

-

✓Letter of Payoff (Only if loan is paid)

-

✓Cancellation Request Form (Signed)

Why Do Owners Cancel?

Based on consumer forum data and automotive surveys, these are the primary drivers for cancellation requests.

Disclaimer: Refund values and procedures may vary by state regulations and specific contract terms. Always consult your specific Ford Protect contract agreement. This infographic is for informational purposes only.

© 2024 FordMasterX – Automotive Research

The Asset Class: Deconstructing Ford Protect and ESP

To navigate the cancellation process effectively, one must first possess a nuanced understanding of the asset being terminated. The terminology surrounding these contracts has evolved, but the underlying legal framework remains consistent.

Brand Evolution: From ESP to Ford Protect

For decades, Ford's proprietary coverage was known simply as the "Ford ESP" (Extended Service Plan). In late 2016, a strategic rebranding initiative transitioned this nomenclature to "Ford Protect".8 This shift was not merely cosmetic; it aligned Ford’s offering with broader industry trends emphasizing "protection" products (tire and wheel, dent care, windshield coverage) alongside mechanical coverage. However, for the purposes of cancellation and administration, "Ford ESP" and "Ford Protect" are synonymous. They are administered by the same entity—typically Ford Motor Service Company or The American Road Insurance Company—and are governed by the same master terms regarding refund eligibility.8

Consumers holding older contracts labeled "ESP" possess the same rights as those with newer "Ford Protect" contracts. The cancellation algorithms, distinct from the marketing gloss, rely on the contract's "In-Service Date" and the specific plan code (e.g., PremiumCare, ExtraCare), rather than the branding on the brochure.8

The Legal Status of the Contract

A critical distinction in the automotive finance world is that a Ford Protect plan is technically a Vehicle Service Contract (VSC), not an insurance policy, in the majority of United States jurisdictions.9 This distinction is vital for regulatory oversight.

- Federal Definition: A warranty is included in the price of the product (the car). A VSC is sold separately for an additional cost. Therefore, federal laws regarding "warranties" (like the Magnuson-Moss Warranty Act) apply differently to VSCs.10

- The Insurance Exception: In specific states, most notably Florida, these contracts are regulated strictly as insurance. This subjects them to the oversight of the State Insurance Commissioner, resulting in fixed pricing (dealers cannot discount or markup the plan arbitrarily) and rigid, statutory cancellation fee caps.6

The "Chassis-Centric" Coverage Model

Unlike a personal life insurance policy or a health plan, a Ford Protect contract is tied to the Vehicle Identification Number (VIN), not the social security number of the buyer.8 The VIN serves as the anchor in Ford's national database (OASIS). This "chassis-centric" structure is the mechanism that allows for transferability to subsequent owners, but it also dictates the cancellation workflow. When a request is made, the administrator queries the VIN to determine the "In-Service Date"—the date the vehicle was first sold as new. This date, rather than the date the warranty was purchased, often anchors the expiration timeline, a detail that frequently confuses consumers calculating their potential refund.12

The Financial Calculus of Cancellation: Actuarial Proration

The core of the cancellation decision lies in the financial return. Unlike a subscription service that might offer a simple pro-rata refund based on time, VSCs utilize a complex depreciation formula based on two variables: Time and Mileage. Understanding this math is essential to determining whether cancellation is the optimal economic move.

The Two-Variable Depreciation Curve

Ford Protect contracts depreciate based on the "Lesser of Time or Mileage" consumed. This implies that the refund is calculated based on the variable that has been used most aggressively relative to the plan's allowance.4

The Proration Formula

The theoretical formula used by Ford Protect Administration to calculate the refund ($R$) can be expressed as follows:

$$R = (P \times \min(T_{rem}, M_{rem})) - F$$

Where:

- $P$ = The original Purchase Price of the plan.

- $T_{rem}$ = The percentage of time remaining on the contract.

- $M_{rem}$ = The percentage of mileage remaining on the contract.

- $F$ = The Cancellation Fee (typically $75, though state laws vary).

Critical Nuance: The "In-Service" Baseline

Most Ford Protect plans (e.g., a 7-Year / 100,000-Mile plan) begin their "clock" at the vehicle's original in-service date (zero miles, day one of ownership), not the date the extended warranty was bought.8

- Example: A consumer buys a used Ford F-150 that is 2 years old with 20,000 miles. They purchase a "7-Year/100k" plan. This plan essentially provides 5 years and 80,000 miles of additional coverage.

- Refund Impact: If this consumer cancels the plan 2 years later, the calculation considers the car to be 4 years old. The refund is based on the 4 years of "used" time against the 7-year total, even though the consumer only held the contract for 2 years. This "concurrent coverage" period (where the factory warranty and ESP overlap) is factored into the total cost and the total refund, often diluting the return value more than the consumer anticipates.12

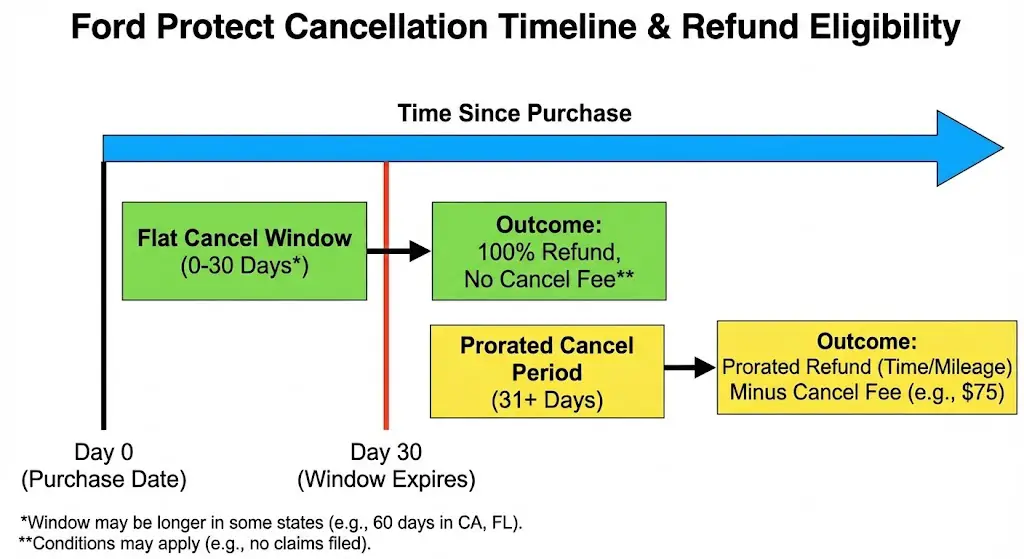

The "Free Look" Period vs. Prorated Refunds

The timeline of cancellation creates two distinct financial outcomes:

- The Flat Cancel (0-30 Days): If the contract is cancelled within 30 days (or 60 days in states like California) of the purchase date, and no claims have been filed, the consumer is entitled to a 100% refund of the purchase price. In this window, the cancellation fee is frequently waived.4

- The Prorated Cancel (31+ Days): Once the "Free Look" period expires, the refund becomes prorated. The $75 administrative fee (or state-equivalent) is deducted from the final amount.8

The Economics of Claims and Cancellations

A vital "hidden" variable in the refund equation is the status of paid claims. In many standard third-party warranty contracts, the value of any claims paid is deducted from the refund amount. However, Ford Protect policies generally provide a prorated refund regardless of claim history, although this is subject to specific state interpretations.

- Comparative Insight: Some third-party administrators will deny a refund entirely if a claim has been filed, or subtract the repair cost from the premium, often resulting in a zero balance. Ford's OEM backing typically ensures a more consumer-friendly "time/mileage" calculation without deducting repair costs, though verifying this in the specific contract's fine print is mandatory.7

Lienholder Priority: The "Cash Flow" Misconception

A pervasive misunderstanding is that the refund check will be mailed to the vehicle owner. In reality, the destination of the funds depends on the lien status of the vehicle.

- Active Loan: If the Ford Protect plan was financed into the auto loan (which occurs in ~90% of dealer sales), the refund belongs to the lienholder (the bank). Ford Protect will issue the check to the lender, who will apply it to the principal balance of the loan.1

- Result: The monthly payment does not change. The number of remaining payments decreases, or the final balloon payment is reduced. The consumer sees no immediate cash.

- Paid-in-Full: Only if the consumer can provide a "Lien Release" document or proof that the loan is satisfied will the check be cut directly to the owner.

- Budco Financing: If the warranty was financed separately via Ford's installment partner, Budco, the refund goes to Budco to satisfy that specific debt first.5

The Dealership Incentives: Why Cancellation is Difficult

The cancellation process is often fraught with friction. This friction is not accidental; it is a structural byproduct of the automotive dealership's "Finance and Insurance" (F&I) revenue model. Understanding this helps the consumer navigate the delay tactics they may encounter.

The Commission Chargeback Mechanism

When an F&I manager sells a Ford Protect plan for $2,500, the dealership retains a significant portion as profit—often $1,000 or more. This income is recognized immediately. However, the dealership agreement with Ford stipulates that if the plan is cancelled (typically within the first year or a specific pro-rata window), the dealer typically suffers a "chargeback".1

- The Conflict: Processing a cancellation essentially forces the Finance Manager to return their commission. This creates a powerful disincentive to process the paperwork efficiently.

- Tactics: Common delay tactics include "losing" the cancellation form, claiming the manager is on vacation, or stating that the process takes "months" when it typically takes weeks.18

The Dealer vs. The Administrator

While the dealer is the selling agent, Ford Protect (The American Road Insurance Company) is the administrator. The dealer acts as the intermediary. If the intermediary is obstructive, the consumer has the right—and often the necessity—to bypass the dealer and deal directly with the administrator. This is a crucial strategic pivot for any consumer facing dealership apathy.2

Procedural Roadmap: Executing the Cancellation

To successfully cancel a Ford Protect contract, precision in documentation is required. Vague requests or phone calls are insufficient; the bureaucracy requires a paper trail.

Channel Selection: Dealer vs. Direct

There are two primary pathways to execute a cancellation:

| Channel | Pros | Cons | Best For |

| Originating Dealer | Access to original file; can verify mileage on-site. | Incentivized to delay; high friction; potential "lost" paperwork. | Flat cancels (0-30 days); active relationship with dealer. |

| Direct to HQ (Ford Protect) | Bypasses dealer obstruction; creates verifiable paper trail; objective processing. | Requires customer to gather all docs; no face-to-face confirmation. | Prorated cancels; hostile/defunct dealers; remote purchases. |

Documentation Requirements

Based on the standard ESP Coverage Cancellation Request form 20, the following data points are mandatory. Missing any single field can result in the rejection of the request.

- Vehicle Identification Number (VIN): The absolute identifier.

- Current Odometer Reading: This must be accurate. If the reading provided is lower than the last recorded service visit in the Ford OASIS system, it will trigger a fraud alert.

- Reason for Cancellation:

- Code 1 (Sold/Traded): Requires bill of sale or odometer statement.

- Code 2 (Total Loss): Requires insurance settlement letter.5

- Code 3 (Repossession): Requires lienholder notice.

- Code 7 (Customer Request): Voluntary cancellation.

- Lienholder Information: Name and address of the bank if the loan is active.

- Signature: The owner must sign to acknowledge the relinquishment of rights.20

The "Direct-to-HQ" Protocol

If the dealership is unresponsive, the consumer should compile the "Cancellation Packet" and submit it directly to Ford Protect Administration.

- Mailing Address: Ford Protect Administration, P.O. Box 6045, Dearborn, Michigan 48121.21

- Phone Support: 1-800-521-4144 or 1-800-392-3673.2

- Digital Submission: Volume sellers like Flood Ford or Lombard Ford often provide digital portals or dedicated email addresses for plans purchased through them (e.g., specific support emails found on their sites), but plans bought at physical dealers usually require physical mail or fax to HQ if the dealer is bypassed.23

Sample Cancellation Letter Structure

To maximize efficacy, a cover letter should accompany the form.

- Header: Date, VIN, Policy Number (if known).

- Body: "I am writing to request the immediate cancellation of the Ford Protect Extended Service Plan for the above-referenced vehicle. Enclosed is the odometer statement and the required cancellation form. I request the refund be calculated based on the postmark date of this letter."

- Lienholder: "The vehicle is currently financed with. Please forward the refund to them directly." OR "The vehicle is paid in full; enclosed is the lien release. Please issue the check to [Owner Name].".25

State-Specific Regulatory Variances

The United States does not have a unified regulatory framework for Vehicle Service Contracts. State laws supersede the master contract terms, creating significant variances in refund rights and fees.

Florida: The Protected Insurance Market

In Florida, VSCs are regulated as insurance.

- Price Fixing: Dealers must sell the plan at the price filed with the Insurance Commissioner. Discounting is illegal.

- Cancellation Fees: Florida statutes strictly limit cancellation fees, often capping them at 5% or 10% of the unearned premium, or a fixed dollar amount (e.g., $40-$50), which may differ from the national $75 standard.6

- 100% Refund Window: Florida typically mandates a 60-day window for a 100% refund, double the standard 30-day window in many other states.

California: Song-Beverly and Consumer Strength

California’s "Song-Beverly Consumer Warranty Act" creates a robust protection environment.

- MBI vs. VSC: California distinguishes between Mechanical Breakdown Insurance (MBI) and VSCs.

- Remote Sales Ban: Out-of-state retailers (like the popular online discounters) are generally prohibited from selling Ford Protect plans to California residents due to licensing requirements. This forces CA residents to buy from in-state dealers, often at higher prices.6

- Refund Calculation: The California Civil Code mandates a pro-rata refund based on elapsed time or mileage. Crucially, the cancellation fee is capped at the lesser of 10% of the refund or $25. This is significantly lower than the national $75 fee.27

Other Jurisdictional Nuances

- Alabama: Consumers are entitled to a 10% penalty added to their refund for every month the provider is late in paying (typically after 45 days).7

- Illinois: Requires specific disclosures regarding wear-and-tear. Cancellation fees are capped at the lesser of $50 or 10% of the contract price.7

- Arizona: Prohibits the exclusion of pre-existing conditions if the provider could not have reasonably known about them, protecting consumers from "bad faith" cancellation denials.7

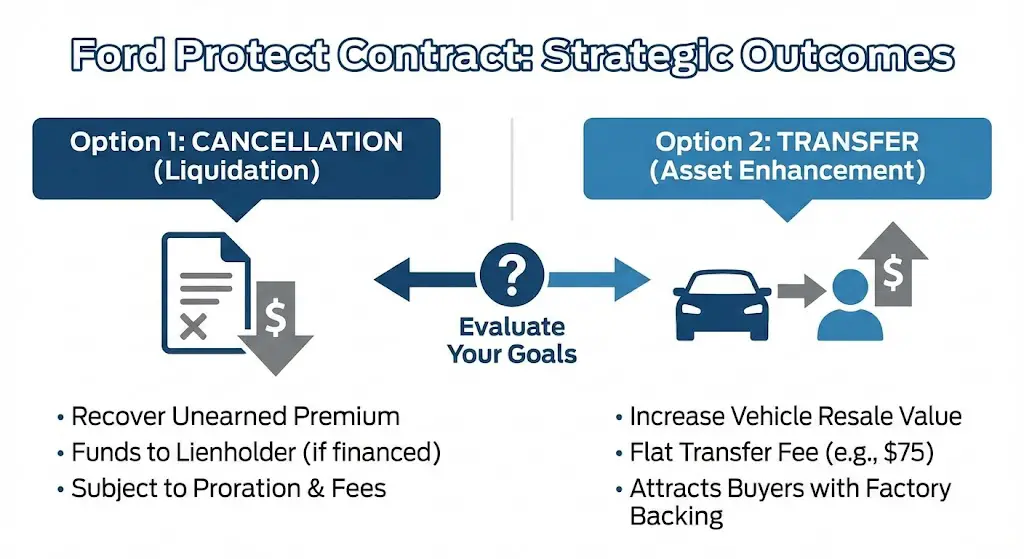

Strategic Asset Management: Transfer vs. Cancel

Before executing a cancellation, a savvy owner should evaluate the "Transfer Option." Ford Protect plans are fully transferable assets that can enhance the resale value of a vehicle.

The Transfer Value Proposition

A Ford Protect plan stays with the VIN. If a vehicle is sold to a private party, the coverage can be transferred for a flat fee, typically $75 ($40 in Florida).8

- The Arbitrage: If the pro-rata refund for a plan is calculated to be $400, but the presence of the warranty allows the seller to increase the vehicle's asking price by $1,000, the "Transfer" strategy yields a $600 net gain over the "Cancel" strategy.

- Marketability: Used car buyers value "factory-backed" protection highly. Listing a vehicle as "Ford Warranty Remaining" often decreases time-on-market.14

Transfer Procedures

- Timeline: Transfers must usually be initiated within 180 days of the vehicle sale.22

- Documentation: A letter signed by the original owner authorizing the transfer, the new owner’s name and address, and the odometer reading at the time of transfer.

- Restriction: Transfers generally apply to private party sales. If a vehicle is traded into a dealership, the dealer usually cannot "assume" the customer's warranty to resell it as their own. In trade-in scenarios, cancellation is almost always the correct financial move.5

Comparative Market Analysis: OEM vs. Third-Party

Understanding why one might cancel a Ford Protect plan often involves comparing it to the broader market.

- Solvency and Security: Ford Protect is backed by the OEM. This ensures that even in economic downturns, the claims reserve is secure. Third-party warranty companies (administered by risk retention groups) have a higher historical failure rate. In the event of a third-party bankruptcy, unearned premiums are often lost.10

- The "Double Cancellation" Strategy: A common tactic among knowledgeable Ford owners involves purchasing a vehicle at a dealership, accepting the high-markup warranty to secure a lower interest rate (if tied to financing), and then immediately cancelling that warranty to purchase the exact same Ford Protect coverage from an online volume seller (like Flood Ford or Granger Ford) for 40-50% less.29

- Mechanism: The owner exercises the 30-day "flat cancel" right on the dealer policy (getting a full refund to the loan) and buys the new policy online. This arbitrage saves thousands of dollars while maintaining full factory coverage.

Troubleshooting and Dispute Resolution

The path to a refund is rarely linear. Dealers may stall, and paperwork may vanish.

Dealing with Dealer Obstruction

If a dealer refuses to provide the cancellation form or stops returning calls:

- Escalate to the General Manager: Bypass the Finance Director. The GM is concerned with the store's "Customer Viewpoint" (CVP) scores from Ford. A threat to tank the survey often prompts action.

- The "Certified Mail" Bypass: Stop calling. Send the cancellation request directly to the dealer via Certified Mail with Return Receipt. The legal "date of cancellation" is anchored to the postmark. If they sit on it for 3 weeks, they still owe the refund based on the postmark date.15

Corporate Intervention

Ford Motor Company maintains a Customer Relationship Center (1-800-392-3673).31 Opening a "Case" generates a ticket that tracks dealer responsiveness. While Corporate cannot force an independent franchise to write a check instantly, the pressure of an open corporate complaint is significant leverage.32

Legal Recourse

In extreme cases where a dealer refuses to refund unearned premiums (essentially theft):

- State Attorney General: Filing a consumer complaint regarding "Deceptive Trade Practices."

- Department of Insurance: In states like Florida or California, the Insurance Commissioner has direct enforcement power over warranty administrators.33

Conclusion

The cancellation of a Ford extended warranty is a financial transaction that demands the same level of attention as the purchase of the vehicle itself. It is not merely a request for customer service; it is the liquidation of a depreciating asset. By understanding the "In-Service" dates, the proration math, and the incentives driving dealership behavior, the consumer can extract the maximum residual value from their contract.

Whether shifting to a new vehicle, capitalizing on the private party transfer value, or simply correcting a high-pressure purchase decision, the protocols outlined in this report provide the definitive roadmap for navigating the Ford Protect ecosystem. The contract is binding, but the exit clauses are clear—for those who know how to enforce them.